inheritance tax wisconsin rates

The average cost of a funeral is 7404 and medical expenses associated with dying tend to total 13234. Reporting and tax rules may apply to the asset.

Property Taxes Property Tax Analysis Tax Foundation

Surprising Data Reveals the Top 25 Tax-Friendly States to Retire.

. Tax resulting from the death transfer. In North Carolina theres no estate tax or inheritance tax so you wont have to worry too much about what might happen to your money after you die. California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also implements an additional tax on those with income of 1 million or more which makes its highest actual tax rate 133.

Also the United States also does not impose an income tax on inheritances brought into the United States. New Jersey and New York also implement this type of millionaires tax. Indiana state income tax rate is 323.

Learn Indiana income property and sale tax rates so that you can estimate how much you will pay on your 2021 taxes. The United States does not impose inheritance taxes on the beneficiarys receipt of a bequest therefore there is no US.

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

Wisconsin State Economic Profile Rich States Poor States

Annuity Taxation How Various Annuities Are Taxed

The Federal Estate Tax An Important Progressive Revenue Source Itep

Property Taxes Property Tax Analysis Tax Foundation

Annuity Taxation How Various Annuities Are Taxed

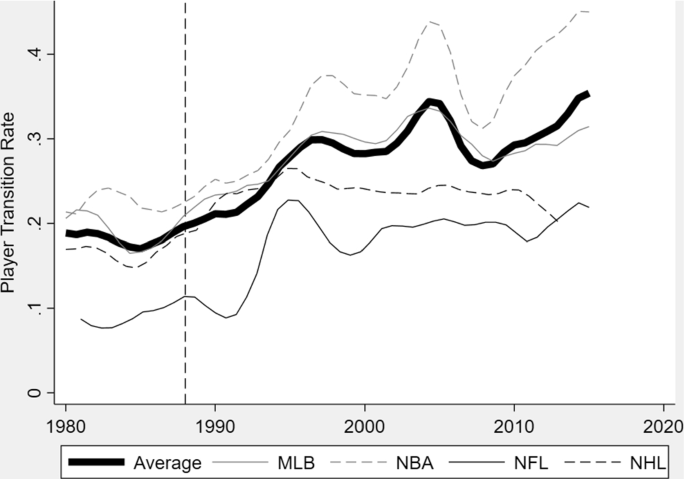

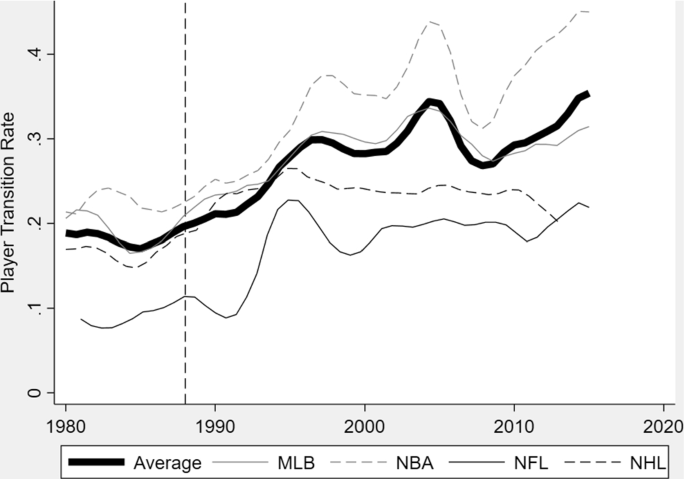

State Income Taxes And Team Performance Springerlink

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Property Taxes Property Tax Analysis Tax Foundation

Property Taxes Property Tax Analysis Tax Foundation

Wisconsin State Economic Profile Rich States Poor States

North Carolina Estate Tax Everything You Need To Know Smartasset

6 Ways To Pass Wealth To Your Heirs

Property Taxes Property Tax Analysis Tax Foundation

Thinking About Moving These States Have The Lowest Property Taxes